Take Control of Your Finances

Your Path to Debt Freedom Starts Here

Are you having difficulty repaying a loan or credit card with your bank?

Fill out this form, and let’s connect

Services

Best Services That Make Everything Easy

Find Your Financial Footing: Expert Guidance Every Step of the Way with CreditCare Credit Management LLC

Mission Statement:

Our mission is to empower individuals with the knowledge and tools they need to overcome debt, achieve financial stability, and pursue their dreams

Empowering individuals to achieve financial freedom through comprehensive debt management solutions, education, and personalized support, ensuring a pathway to a debt-free future and greater economic well-being.

Cultivating a community committed to breaking free from the shackles of debt, our mission is to provide accessible tools, resources, and expert guidance to navigate the complexities of debt management. With a focus on transparency, integrity, and empathy, we strive to empower individuals to regain control of their finances, alleviate stress, and pave the way for long-term financial stability. Together, we envision a world where everyone has the knowledge and support needed to conquer debt and build a brighter financial future

Breaking Point:

Debt Weighing You Down

Feeling overwhelmed by debt? You’re not alone. Take the first step towards financial freedom today.

Freedom Found:

Embracing Financial Independence with CreditCare Credit Management LLC

Imagine the feeling of freedom that comes with being debt-free. It’s possible with the right plan and determination. Start your journey to financial independence now.

About Us

Debt Doesn't Define You: Take the First Step Towards Freedom

At our core, we’re dedicated to supporting individuals on their journey towards financial liberation. We understand that debt can feel overwhelming and suffocating, but we firmly believe that it doesn’t have to be a permanent fixture in one’s life.

Our mission is to provide a supportive and empowering environment where individuals can take that crucial first step towards freedom. We offer comprehensive resources, personalized guidance, and a community of like-minded individuals who are all striving towards the same goal.

We recognize that every person’s financial situation is unique, which is why we tailor our approach to meet the diverse needs of our community. Whether it’s creating a realistic repayment plan, providing financial education, or offering emotional support, we’re here to walk alongside our members every step of the way.

You Need to Know Why You Should Choose Us

Features

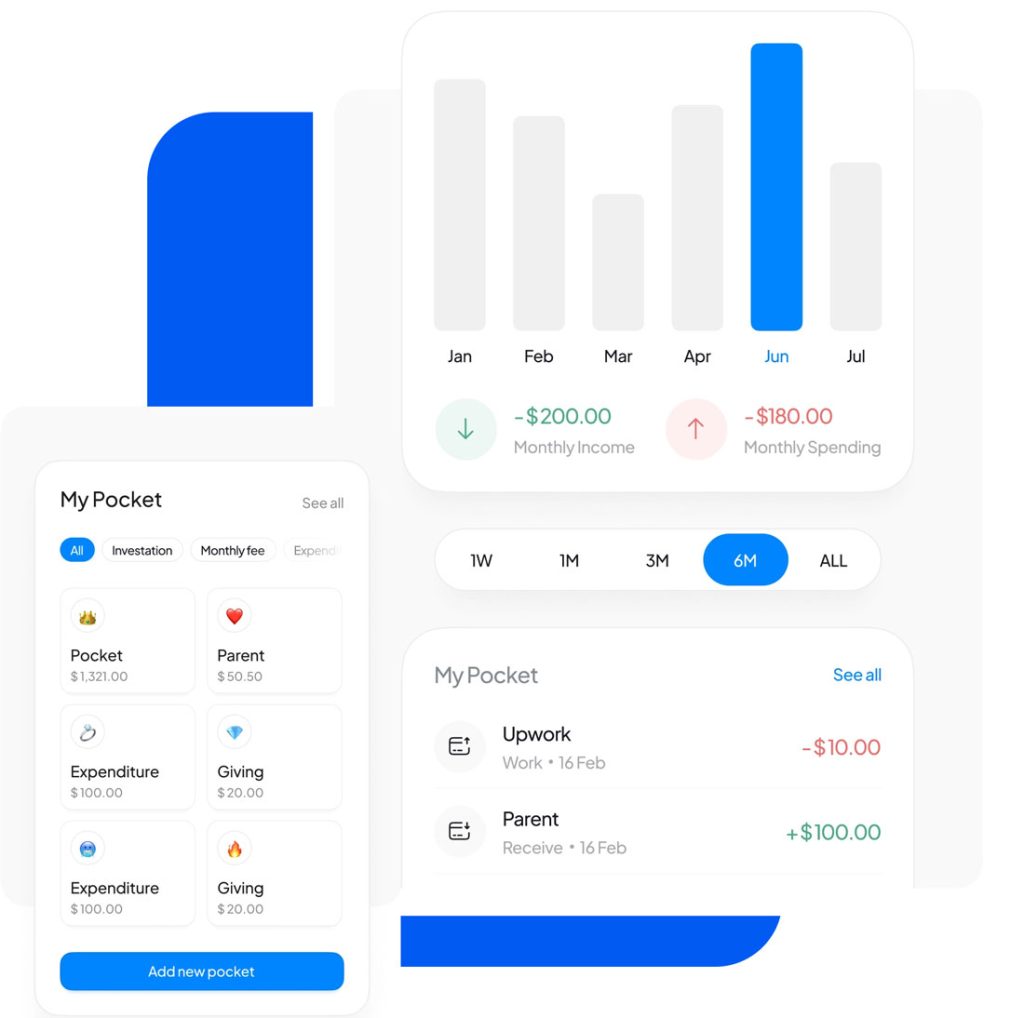

See How Our Features Work For Your Business

Our personalized debt management plans are designed to fit your unique financial circumstances and goals. Whether you’re struggling with credit card debt, student loans, or medical bills, we’ll work with you to create a realistic plan for debt repayment

- Free consultation with a financial advisor

- Tailored debt repayment strategy

- Budgeting tips and resources

- Ongoing support and progress tracking

FAQ

Frequently Asked Questions

Debt management involves creating a structured plan to effectively manage and pay off debt. It often includes negotiating with creditors to lower interest rates, consolidating debts into a single monthly payment, and providing support and resources to help individuals achieve financial stability.

- Debt management can help you reduce your debt burden, lower interest rates, simplify your payments, and ultimately achieve financial freedom. It provides a structured approach to tackling debt and can offer relief from financial stress.

- Our debt management program works by assessing your financial situation, negotiating with creditors on your behalf to lower interest rates and waive fees where possible, and consolidating your debts into a single monthly payment.

- Our debt management program is typically available to individuals with unsecured debts such as credit cards, medical bills, personal loans, and certain types of student loans. Eligibility is based on factors such as income, debt amount, and financial hardship.

- Our debt management program typically includes unsecured debts such as credit card debt, medical bills, personal loans, and certain types of student loans. Secured debts like mortgages or auto loans are generally not eligible.

- The duration of our debt management program varies depending on individual circumstances such as the amount of debt, income level, and financial goals. On average, clients complete the program within three to five years.

Let's Make Our Communities Debt Free!

Our mission is to usher in a debt-free era for residents, where financial empowerment and stability are within everyone’s reach.

At CreditCare Credit Management LLC, we are dedicated to breaking the chains of debt that hinder individuals and families from realizing their full potential.

We believe that every individual deserves the opportunity to thrive without the burden of overwhelming debt. Through tailored strategies, expert guidance, and unwavering support, we are committed to empowering our community to take control of their finances and embark on a journey towards lasting financial freedom.